|

4. Familiarize Yourself With Key Commercial Real Estate Metrics The general key metrics for property valuation include (Part 2): - Cap Rate The "cap" - or capitalization rate - of a real estate property is used to calculate the value of income-generating property. For example, a residential complex with five or more residential units, commercial office buildings and smaller shopping centers are good candidates for determining the upper limit. Cap rates are used to estimate the present value of future profits or cash flows. The process is also known as profit capitalization. - Cash on Cash It is sometimes referred to as the return on a property investment. The cash-on-cash return offers business owners and Joker123 investors an analysis of the business plan for a property and the potential cash distribution over the term of the investment. Investors of commercial real estate who rely on finance to purchase their properties often use the cash-on-cash formula to compare the performance of competing properties in the first year. According to Agen Poker Terpercaya, cash-on-cash takes into account the fact that the investor in question does not need 100% cash to buy the property (long-term borrowing), but also the fact that the investor will not keep everything NOI because he or she has a part of which must be used for mortgage payments. To get cash, real estate investors need to determine the amount required to buy the property or make their initial sbobet88 investment. Calculations based on the standard ROI take into account the total return on an investment. The cash-on-cash return, on the other hand, only measures the return on the money actually invested and provides a more precise analysis of the performance of the investment. Read More : 7 Steps of A Commercial Real Estate Deal Part 1 5. Look for Motivated Sellers Like any company, customers drive real estate. Your job is to find them - especially those who are willing and eager to sell below market value. The fact is that nothing happens or matters in real estate until you find a store that is usually accompanied by a motivated seller. This is someone with an slot game urgent reason to sell below market value. If your seller is not motivated, he or she is not ready to negotiate. 6. Discover the Art of Neighborhood "Farming"

An excellent way to evaluate a commercial property is to examine the neighborhood it is in by opening houses, talking to other owners of the neighborhood, and looking for game slot vacancies. Use a three-step approach to assess the properties Be adaptable when looking for cheap deals. Use the internet, read the classified ads and rent bird dogs to find the best property for you. Real estate bird dogs can help you find valuable investment leads for a transfer fee. 7. The Bottom Line On the whole, finding and valuing commercial property is not just about managing neighborhoods, getting a cheap price, or sending smoke signals to get sellers to you. Basic human communication is at the center of action. It's about building relationships and building relationships with the owners so that they feel comfortable talking about the good Agen Sbobet business - and doing business with you. Tags : Commercial, Real Estate, Properties, Deal, Steps

1 Comment

1. Learn What the Insiders Know To be a player in commercial real estate, learn how to think like a professional. For example, do you know that commercial real estate is valued differently than home ownership. The income from commercial real estate is directly related to the usable area. This is not the case with individual apartments. You will also see a larger cash flow with commercial real estate property. The calculation is simple: for example, you earn more money with multi-family houses than with single-family houses. Also note that commercial leases take longer than single-family homes. This paves the way for more cash flow. If you are in a tight credit joker123 environment, you should definitely tap cash. Commercial property lenders want to look at least 30% down before giving a green light to a loan. 2. Map Out A Plan of Action In a commercial property business, setting Agen Poker Online parameters is a top priority. For example, ask yourself how much you can afford to pay mortgages, and then search for mortgages to get an idea of how much you will pay over the life of the mortgage. Tools such as mortgage calculators can help you make a good estimate of the total cost of your home. 3. Learn to Recognize a Good Deal The top real estate professionals know a lot when they see one. What's your secret First, they have an exit strategy - the best deals are the ones you know you can leave. According to Agen Poker Terpercaya, it is helpful to keep a keen eye on the landowner - always look for damage that needs to be repaired, assess the risk, and break out the calculator to make sure the property reaches your financial goals. 4. Familiarize Yourself With Key Commercial Real Estate Metrics The general key metrics for property valuation include (Part 1): - Operating profit (NOI)

The NOI of a commercial property is calculated by evaluating the gross operating income of the property in the first year and then deducting the operating expenses for the first year. The Net Operating Income (NOI) is a calculation that analyzes the profitability of income-generating real estate investments. NOI corresponds to all income from the property minus all reasonably necessary operating costs. The NOI is a value before taxes that is shown in the income statement of a property without capital and interest payments for loans, investments, depreciation and amortization. When used in other industries, this metric is referred to as "EBIT", which stands for "earnings before interest and taxes". Read More : How to Make Money in Real Estate Part 2 Formula: Operating result = RR - OE Where: RR = Real Estate Revenue OE = operating costs Operating profit is a valuation method that real estate professionals use to determine the exact value of their income-generating real estate. In order to calculate the NOI, the operating game slot costs of the property must be deducted from the income that a property generates. In addition to rental income, a property can also generate income from amenities such as parking garages, vending machines and laundry facilities. The operating costs include the costs of operating and maintaining the building, including insurance premiums, legal costs, ancillary costs, property taxes, repair costs and caretaker fees. Investments such as B. Costs for a new air conditioning system for the entire building are not included in the calculation. NOI helps real estate investors determine or decide the capitalization rate. This in turn helps them calculate Agen Sbobet property value and allows them to compare different properties that they may want to buy or sell. In the case of financed real estate, the NOI is also used as part of the debt coverage ratio (DCR), which tells lenders and investors whether a property's income covers its operating costs and debt repayments. NOI is also used to calculate the net income multiplier, return on sbobet88 investment and total return on investment. Tags : Commercial, Real Estate, Properties, Deal, Steps Income The second great way in which real estate property creates wealth is by regularly paying out income. Generally referred to as rent, property income can be generated in a variety of ways. Raw Land Income Depending on your rights in the country, companies may pay royalties for discoveries or regular payments for structures they add. These include pump jacks, pipelines, gravel pits, access roads, cell towers, etc. Rohland can also be rented for production, usually agricultural production. Residential Property Income The main part of the owner-occupied home income comes from the basic Agen Sbobet rent. Your tenants pay a fixed amount per month - and that will increase with inflation and demand - and you take your costs out of it and use the remaining part as rental income. While it is true that you get an insurance payout when your tenants burn the place down, the payout only covers the cost of replacing what is lost and is not really income. Commercial Property Income Commercial real estate can generate income from the aforementioned sources, with the basic rent again being the most common, but it can also be added in the form of option income. Many commercial tenants pay fees for contract options such as the right of first refusal in the office next door. Tenants pay a premium to keep these options whether they exercise them or not. Option income sometimes exists for raw land and even home ownership, but is far from common sbobet88. Alternatives Real estate investment trusts (REITs), mortgage-backed securities (MBSs), mortgage investment companies (MICs) and real estate investment groups (REIGs) can be described as alternatives within the real estate sector. These joker123 investments are generally considered to be a means of generating property income, but they have different methods of doing so and different methods of access. Read More : How to Make Money in Real Estate Part 1 In a REIT, the owner of several commercial properties sells shares (often publicly traded) to investors (usually to finance the purchase of additional properties) and passes the rental income on in the form of a distribution. The REIT is the landlord for the tenants (who pay the rent), but the owners of the REIT record the income once the expenses for operating the buildings and the REIT are removed. There is a special method for evaluating a REIT. MBSs and MICs are yet another step away as they invest in private mortgages rather than the underlying real estate. MICs differ from MBS in that they hold whole mortgages and pass the interest on payments to Agen Poker investors instead of securitizing part of the capital and / or the interest. Still, both are less real estate investments than debt investments. Other alternatives such as REIGs can also exist. REIGs are usually private investments with their own structure that offer investors equity investments or partnership services. There are several credible real estate alternatives to make money in the industry, but they have different limitations and entry points. Smoke and Mirrors

Similar to other alternatives that involve real estate investment, most methods that impress you with a fantastic return are just one layer above the basic income streams. For example, there are informal residential real estate options where you pay a fee or premium to have the right to buy a house for a period of time at an agreed price. Then you will find investors who pay more than your option price for the property. In this case, the premium you get is essentially an agency fee for assigning a person looking for an investment to a person looking to sell. According to Agen Poker Terpercaya, although this is income, it does not come from owning (i.e. owning the deed) a piece of land. Tags : Real Estate, Properties, Earn, Money, Methods Appreciation The most common way that real estate brings a profit: you value it - that is, it increases its value. This is achieved in different ways for different types of real estate property, but only in one way: through sale. However, there are a number of ways you can increase a property's return on investment. One of them - if you borrowed money to buy it - is to refinance the loan at lower interest rates (use our mortgage calculator to calculate the current refinancing rates). This lowers your cost base for the property and thus increases the amount you remove from it. Raw Land Of course, the most obvious source of appreciation for undeveloped land is development. As cities expand, land outside of borders becomes more and more valuable as it can potentially be bought by Agen Poker Online developers. Then developers build houses that increase this value even further. The appreciation of land can also result from the discovery of valuable minerals or other goods on it, provided the buyer has the rights to it. An extreme example of this would be striking oil, but the increase in value can also be achieved through gravel deposits, trees, etc. Residential Property When considering residential real estate, the location is often the greatest value-adding factor. As the neighborhood of a home evolves, adding transit routes, schools, shopping centers, playgrounds, etc. can add value. Of course, this trend can also work in the opposite direction, whereby the house values decrease with the decline of the neighborhood. Read More : Real Estate VS Real Property Home improvements can also boost appreciation, and this can be controlled directly by a property owner. Setting up an additional bathroom, heating a garage and remodeling a kitchen with the latest equipment are just a few of the ways the Agen Poker owner can try to add value to a home. Many of these techniques have been refined by real estate flippers that specialize in providing homes with high returns in a short amount of time. Real estate remodeling and property turning can be a profitable way to quickly add value quickly, although careful planning is required. Commercial Property Commercial real estate gains in value for the same reasons that raw land and residential real estate do: location, development and improvement. The best commercial properties are in constant demand. The Role of Inflation An important factor to consider when considering the appreciation is the economic impact of inflation. An annual inflation rate of 10% means that your dollar can only buy about 90% of the same good the following year, and this includes real estate. If a property were worth $ 100,000 in 1970 and had been inactive, undeveloped and unpopular for decades, it would be worth many times more today. Given the high inflation in the 1970s and a steady pace since then, it would likely cost over $ 500,000 to buy now, assuming $ 100,000 was a fair market value at the time.

So, according to Agen Poker Terpercaya, inflation alone can make real estate valued, but it's a certain Pyrrhic victory. Even if you get five times the money due to inflation, buying many other goods is now five times as expensive, so purchasing power is still a factor in the current environment. Tags : Real Estate, Properties, Earn, Money, Methods Overview Real estate and real property certainly sound pretty much alike, and the two concepts have a lot to do with each other, but there are subtle differences between them. Understanding these differences can help you understand the intricacies of the country you own and how you own it. While real estate often refers to land, the term real property goes a little further and examines the rights associated with that land. Real Estate Real estate is simply a piece of land plus any natural or artificial, artificial improvements that are appropriate or have been added. Natural buildup is part of the country and includes trees, water, valuable mineral deposits and oil. Artificial improvements include buildings, sidewalks, and fences. Real estate property can be divided into two broad categories: residential and commercial real estate. Residential real estate is property that should be inhabited by a single family or multiple families. Real estate can be leased or used, but the term residential real estate mostly refers to leased real estate. Commercial real estate has a business use and direction. This property includes Agen Poker office buildings, shopping centers, restaurants and other such activities. Commercial real estate can be owned or leased. Industrial real estate is a subdivision of commercial real estate and includes real estate in which manufacturing, storage, production and assembly take place. Real Property Real property is a less common term and therefore a less common concept. Real property is a broader term and includes the property itself as well as all buildings and other improvements associated with the property. It also includes the rights to use and enjoy certain properties and their improvements. Tenants and tenants may have the right to occupy land or buildings, a property matter, but these things are not considered real estate. Real property includes real estate and a bundle of rights is added. This bundle of rights is a broad term for the Agen Poker Online organization of property rights as they relate to real estate. In short, it gives owners the opportunity to use their property at their own discretion. Read More : 6 Real Estate Systems That Should Be Implemented Part 2 A bundle of rights consists of five different rights of the owner: 1. The right to own is the right to occupy the property. 2. The right of control is the right to determine interests and uses for others. 3. The right to enjoy is the right to use the property without outside interference. 4. The right of exclusion is the right to reject foreign interests or uses for the property. 5. The right of disposal is the right to determine how and whether the property is sold or handed over to another party. There are some other complex exceptions and limitations to these rights and legal treatments.

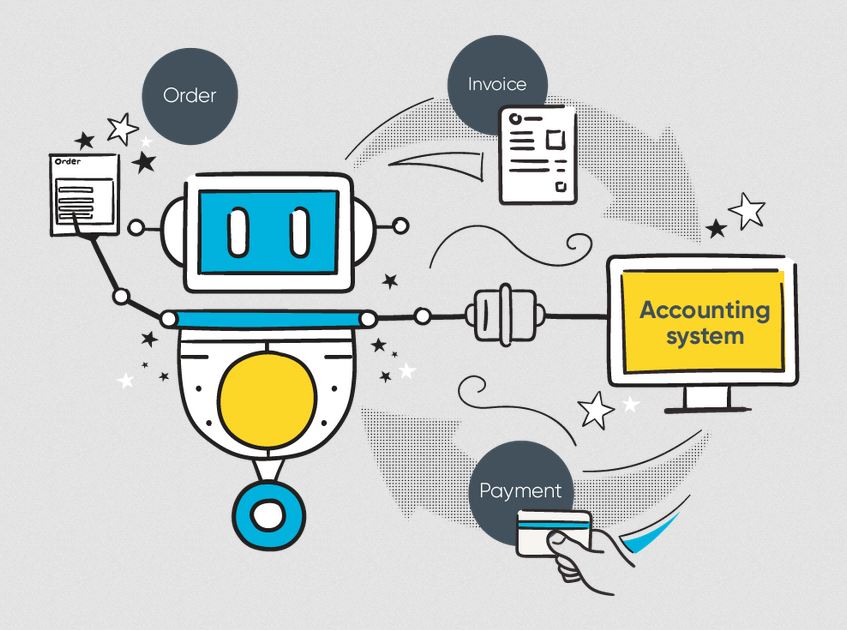

According to Agen Poker Terpercaya, in general, the difference between real estate and real property is due to the inclusion of the bundle of rights. The real property consists of both physical objects and customary rights, whereas the real estate consists only of physical objects. Summary - Real estate is a term that refers to the physical land connected to it, the associated structures and resources. - Real property encompasses the physical property of the real estate, but extends its definition by a bundle of ownership and usage rights. - The distinction is most useful in the real estate world, where different ideas can apply to owners and tenants or tenants. - For most citizens, the real estate concept includes real property, but from a legal point of view, the distinction is important. - The real property consists of both physical objects and customary rights. Real estate consists only of physical objects. Tags : Real Estate, Real Property, Property, Differences, Land 4. Property Evaluation Above all, you need to have a system that you can use to evaluate properties. However, there are so many boxes that need to be checked during a property walk that you only hurt yourself if you don't have a sophisticated system. The risk of missing something very important is drastically reduced. A good property valuation system will almost serve as an inspection before the actual one occurs. First, create a checklist of items that you need to look at. Plumbing, flooring, mechanical items, and foundations should be high on your list. When you are finished looking at all the objects, write down the traffic and the quality of the neighborhood. According to Agen Poker Terpercaya, the more objects you look at, the better you can assess their potential. A good system significantly reduces the likelihood that you will miss something on your next real estate property. Start developing such a property immediately. 5. Working with Sellers I strongly recommend implementing a system that allows you to work seamlessly with salespeople as generating leads is only half the battle. That means you need to be able to turn these leads into actual deals. Every time you have a seller lead, you have to be ready to respond to it, and nothing offers a way to do it better than a proven system. Remember, time is always crucial, and real estate is no exception. A strong system helps you quickly assess how serious the seller is. If this is your first time talking to them, you should have a list of Agen Poker Online questions you want to answer. Only then can you determine the motivation and wishes of the customers for the transaction. Set up a meeting from there and see the property. Once at the property, you should have another set of questions ready to confirm the seller's original answers. The more familiar you are with your seller system, the easier it will be to distinguish the reputable sellers from those who only shop. Read More : 6 Real Estate Systems That Should Be Implemented Part 1 6. Accounting System There is no reason why not every investor should have an accounting system. In fact, it is inexcusable if you fail to implement a system that keeps an eye on accounting. Regardless of whether you focus on rental properties or rehab, you need to have an idea of how money flows into and out of your company. If you don't pay your contractor on time, he won't work that hard for you in the next deal. If you are sloppy with your rental collection, you may encounter a late payment. Accounting is much more than just dealing with money. A system is being developed that pays bills, purchases supplies and best distributes your funds. You will learn which items have to be paid for and how you want to pay them. Even if you have no financial experience, you can develop your own accounting system that works. I suggest doing this sooner rather than later.

Summary These five real estate systems help your company to work more efficiently and effectively. They help you make quick decisions that save you time. Instead of thinking about what to do next, a well-defined system will help you without hesitation. Nevertheless, it's not necessarily the systems that take an investor's career to the next level. it is what they do with their free time. Really great investors take the time they save with real estate systems and apply it to other areas of their Agen Poker business that need more attention. Tags : Real Estate, Systems, Properties, Business, Investors I have been an investor for more than a decade and can assure you that some systems are much more important than others. However, there are those without which you simply cannot invest, or at least I do not recommend them. If you are looking for the way to the forefront of the real estate landscape, Agen Poker strongly recommend that you consider the implementation of these six real estate property systems. 1. Property Search Investing in residential property has become increasingly competitive in recent years. To stay ahead of the competition, investors should learn how to find investment property before others do. Therefore, every investor must have real estate systems in order to find housing market data on investment property. The good news is that you can use real estate investment tools like Mashvisor's Property Finder to find the best investment properties in any city that interests you. According to Agen Poker Terpercaya, with your target budget and investment goals, the tool's AI scans the area you are interested in and produces property propositions (maps). Each card comes with real estate information such as a physical address, an estimated value, a list price, and traditional and Airbnb analysis, including the cash-on-cash return for each rental strategy. The real estate finder uses filters such as miles and cities, budget and rental strategy as well as bedrooms and bathrooms. By integrating this tool into your property search system, you know where you can quickly and easily search for investment property. You don't have to waste time on this process and can easily run it again and again to expand your portfolio with profitable real estate. Read More : Why Are Real Estate Systems Needed? 2. Marketing & Lead Generation Lead generation is one of the foundations of any real estate business. Finding an investment property can be the most important aspect of a business. If you don't do something every day to generate leads, you will likely lag behind the competition. Fortunately, there are systems that help with marketing and lead generation. However, the key is to implement a concept that matches consistent results. I recommend reaching ten real estate agents every Monday morning. You can even spend a few minutes blogging for your website three times a week. Don't hesitate to advertise your Agen Poker Online company on social media next Tuesday. Whatever you choose, you have to schedule time each week. If you want to try out a large campaign, you need to work it out before you start. Everything from the budget, presentation and execution must be thought through before you start pushing things forward. Lead generation cannot be anything that you do between deals or when you are slow. it must be part of your daily routine. Without a system that handles marketing and lead generation, things can quickly get out of control.

3. Deal Structure How do you determine your offer price? Do you have a fixed formula that you use regardless of external factors? Remember, your initial offer is the starting point for buying a business, not the end-all-all. It is important to have a system to determine which properties you are bidding on and what the price will be. You also need to have an idea of how you want to fund them. Certain deals may be better for cash deals, while others should be financed with lenders. In either case, you need to develop a system that can help you quickly determine which path to take. Tags : Real Estate, Systems, Properties, Business, Investors I can assure you that running a business is not an easy thing. A lot of hard work and commitment are what it takes. Entrepreneurs at all levels tend to be everywhere, do everything, and take on as many projects as possible. It is in the nature of the animal. However, I can assure you that there is no faster way to plunge into the ground. Nevertheless, I strongly recommend the implementation of real estate systems to support you in your daily routine. Set up systems that are able to reproduce the results you want to see every day, and make sure that you create a system for every process in your company. According to Agen Poker Terpercaya, there should be a system in place from ordering office supplies to closing deals. In this way, you can expect results regardless of who is responsible for the task. If you have systems, your company can grow more efficiently. Why you need real estate systems Everyone has the opportunity to invest in a single real estate business with some success. To be very clear, the challenge is not necessarily to turn a single property over, but rather to do a sustainable home business. The constant turning of houses and investing in real estate becomes more and more difficult with increasing volume. However, there are ways to significantly simplify the management of a real estate business for the respective investor. In particular, the right systems are able to rationalize Agen Poker Online companies and ensure success. This is the secret of real estate investments: easy-to-replicate systems that effectively remove investors from the process. With the right systems, investors can essentially move away from the equation without worrying about whether their business will be successful. Read More : When To Use A Double Close? Proven systems - those that have worked for others in the past - can do the following: - Consistent quality: A really great system always implements blueprints for the next steps. As their name suggests, systems give their implementers the steps to reproduce success. Once a system has been identified, tested and proven, there is no reason why success cannot become a habit. The quality that can be expected from a single system should be present with every execution. - Simplify workload: Systems should make life easier for Agen Poker investors. When they are created, they are carried out with great attention to detail and efficiency. As long as the system is used optimally, it should simplify the existing workload. At least a good system identifies the best way to get something done. - Save time: The systems are constantly evolving, which means that they are constantly looking for ways to become more productive and efficient. If investors become familiar with a system, there is no reason why they cannot optimize the systems themselves. - Elimination of inefficiencies: Inefficiencies can be detected by suitable real estate property systems. If something is to be repeated on a regular basis, inefficiencies must not only be recognized, but also eliminated.

- Increase your business: Systems give a lot of time to those who use them correctly. What investors do with this time makes the difference. Those who use their newly gained time could easily spend growing their business. Without having to worry about everyday tasks, investors can concentrate on more important things. Tags : Real Estate, System, Properties, Investors, Business When is the time to use a Double Close? The double-close strategy for real estate wholesale is usually best referred to a reserve role. This does not mean that double closing in real estate is not a viable option, but that it is usually better to award Agen Poker contracts if this is possible. However, the best time for double closing is when selling a contract is not an option. There are two main reasons why a double close should serve as an alternative to sales contracts: financing and fees. To begin with, the sale of a contract can be completed in just a few hours without the need for your own funding. The end buyer is actually the one who pays you for the opportunity to buy the house. Perhaps more importantly, however, the sale of a contract does not involve the fees that apply to real estate transactions. As previously mentioned, double closing requires investors to pay all of the fees and charges that are typical for Agen Poker Online transactions in the real estate industry. If you don't want to pay any additional fees, assigning a contract is a better alternative. Double Close VS Contract Assignment As I have already indicated, there are two main strategies for wholesaling: contracting and double closing. I have already covered the latter extensively, but the former has several differences that warrant your attention. namely the transfer of ownership or the lack thereof. While a wholesaler actually buys the real estate property with a double degree (and therefore adheres to the ownership structure), the wholesaler does not have to buy the property when placing the order. Instead, wholesale strategies (also known as selling a contract) will witness that wholesalers sell their rights to buy the property in question, not the property itself. It's worth repeating: when you sell a contract, you are not selling the property - You are actually selling your right to buy the property to another investor. Read More : What Is A Double Closing? As part of a wholesale contract, the investor signs a contract with the seller giving him the right to buy the property. The contract gives the investor legally a "reasonable interest" in the home topic; you are not entitled to the title. Therefore, according to Agen Poker Terpercaya, when assigning the contract, the investor sells his rights within the terms already agreed with the original seller. In contrast to double closing, an investor will never pull the title or appear in the title chain when a contract is assigned. Perhaps more importantly, placing an order generally does not require financing for the investor. Instead, the new buyer pays the investor the rights to buy the home. Summary of Double Closing Selling a contract has proven a viable exit strategy for today's wholesalers. However, there are many reasons why a contract assignment may not be included in the cards. Therefore, investors need to know how to double close. This way, they can increase their chances of realizing a successful deal. At the very least, access to any strategy ensures that you are able to make more deals.

Tags : Double Closing, Contract Assignment, Property, Real Estate, Wholesalers Great wholesalers are smart enough not to run a business without an appropriate exit strategy. To this end, the most productive wholesalers of our time are always one step ahead. They know that upcoming wholesale stores will require not just one exit strategy, but two. The ability to exercise multiple close options at a time is an advantage for any Agen Poker Online investor and can easily tip the scales in his favor. Of particular importance to today's wholesalers are the two most common methods of doing business: selling a contract and double signing. While most wholesalers tend to prefer the contract allocation method, it is in their best interest to have a backup plan: double closing. Otherwise, it is referred to as a double escrow. A double degree is intended to facilitate a wholesale business if a contract cannot be assigned. it's a plan B, and it's a valuable one. Getting to grips with the double-close real estate strategy that today's best investors already know can make the difference between a good career and a great career. Definition of Double Closing A double closing is an alternative wholesale strategy to the popular method of contract sales. More specifically, an investor in double closures will actually buy a real estate property, then turn it over and sell it relatively quickly - hence the name double lock. A double deal literally means that an investor makes two independent transactions (one with the original seller and one with the end buyer). When all is said and done, a double close is not so different from the way you would normally buy and sell a property. it just happens in a lot less time. It is not uncommon for double closings to take place over hours, days, or weeks. Read More : 7 Characteristics of a Successful Real Estate Developer Part 2 To put things in perspective, a double degree will have two separate transactions. The first transaction takes place between the original home seller and the investor intending to sell the property. The second transaction therefore takes place between the wholesaler and the new buyer. This is an important distinction, since a double deal must consist of two separate transactions, each with their own statements. The first bills, called HUD-1, list the agreed numbers - how much you have negotiated to buy the Agen Poker property. Not surprisingly, the second statement states the price at which you agreed to sell the same property to a final buyer. When it's time to sell the business to another buyer, sign a second purchase and sale contract. However, this time it depends on the first deal (the one where you bought the property from the original owner). As a result, you must disclose that another agreement must be concluded before the subsequent agreement can continue. To be very clear, you have to tell the parties involved in the second transaction everything about the first transaction.

If you have not yet concluded your own double-closing contracts, I strongly recommend that you contact a legal advisor. Only move once a lawyer has made sure everything is up to date. According to Agen Poker Terpercaya, double closing real estate transactions is not witchcraft, but there are many rules that must be followed. With a legal representative in your corner, there's no reason why you shouldn't know how to do a double closing under the law. It should be noted that in the context of a double deal, investors are charged the standard fees associated with a property deal, which correlate directly with the state in which the transaction takes place. In addition, the investor is included in the title chain because he was the owner of the property for a short time. Tags : Definition, Double Closing, Property, Real Estate, Wholesalers |