|

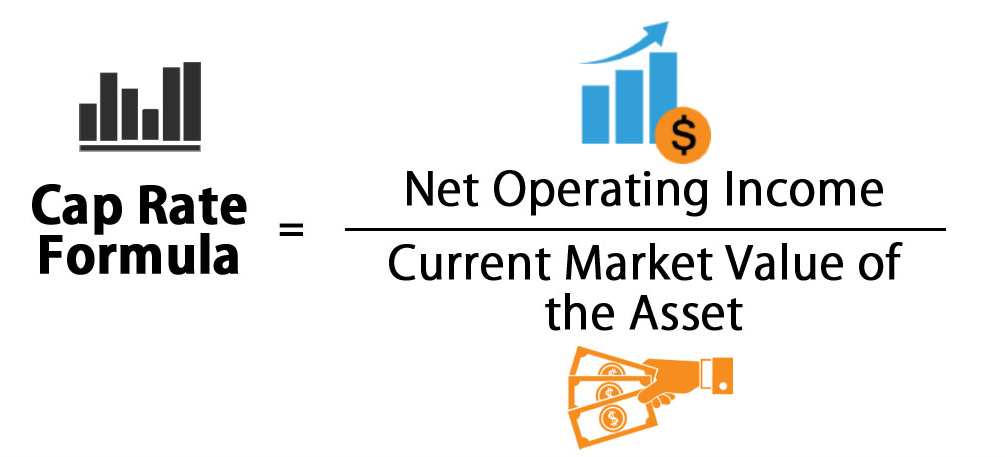

The capitalization rate (also known as the cap rate) is used in the world of commercial real estate to indicate the expected return on investment property. This measure is calculated based on the net profit the property is expected to generate and is calculated by dividing the net operating profit by the value of the real estate property and expressing it as a percentage. It is used to estimate the potential return on the investor's investment in the property market. The cap rate can be useful to quickly compare the relative value of similar property investments in the market. However, it should not be used as the only indicator of the strength of an investment, since it does not take into account the leverage effect, the current value of money and the equivalent, including future cash flows from property improvements. There are no clear areas for a good or bad capitalization rate and they largely depend on the context of the property and the Joker123 market. Capitalization Rate Formula There are several versions for calculating the capitalization rate. In the most common formula, the degree of capitalization of a property investment is calculated by dividing the property's net operating income (NOI) by the current market value. Mathematically, Capitalization rate = operating result / current market value Where, The net operating result is the (expected) annual income of the property (such as rents) and is achieved by deducting all costs incurred for the game slot administration of the property. These expenses include the costs paid for the regular maintenance of the system and property taxes. The current market value of the asset is the current value of the property according to the applicable market prices. Read More : Definition of Capitalization Rate According to Agen Poker Terpercaya, in another version, the number is calculated based on the original cost of capital or the cost of a property. Capitalization rate = operating profit / purchase price However, the second version is not very popular for two reasons. First, it gives unrealistic results for old properties that were bought at low prices a few years / decades ago, and secondly, it cannot be applied to inherited properties because their purchase price is zero, making the division impossible. Since property prices fluctuate widely, the first version that uses the current market price is a more accurate representation than the second version that uses the original purchase price with a fixed value. Gordon Model Representation for Cap Rate

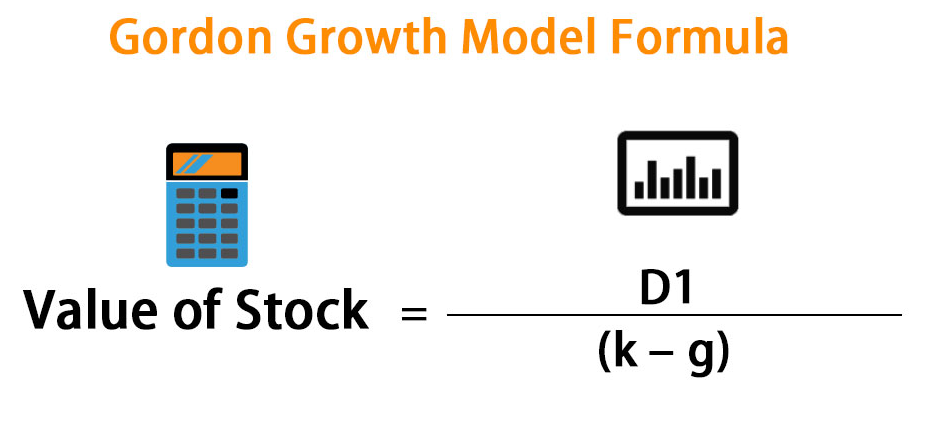

Another representation of the cap rate comes from the Gordon Growth Model, which is also known as the Dividend Discount Model (DDM). This is a method of calculating the intrinsic value of a company's share price regardless of current market conditions. The share value is calculated as the present value of the future dividends of a share. Mathematically, Share value = expected annual dividend cash flow / (return required by investor - expected dividend growth rate) Reorganization of the equation and generalization of the formula beyond the dividend, (Required return - expected growth rate) = expected cash flow / asset The above illustration corresponds to the basic formula of the capitalization rate mentioned in the previous section. The expected cash flow value represents the net operating income and the Agen Sbobet asset corresponds to the current market price of the property. As a result, the capitalization rate corresponds to the difference between the required return and the expected growth rate. That means the cap rate is simply the required return minus the growth rate. Tags : Real Estate, Properties, Capitalization Rate, Formula, Commercial Real Estate

0 Comments

Leave a Reply. |