|

Don't underestimate your feelings and don't overestimate your finances Buying a house is a very emotional process. Allowing these emotions to get the most out of you can fall victim to a number of common buyer mistakes. Since home ownership has many far-reaching effects, it is important to keep your emotions in check and make the most rational decision possible. Slot Game Online. Your goal is to look for a home that you love at a price that you can afford, but unfortunately, many people do things that prevent them from realizing that dream. Let's take a look at some of the most common mistakes made when looking for a home - and how to find a properly. Slot Game Online. House-Hunting Mistakes (Part 4) : 9. Ignore The Neighborhood Do not only concentrate on the residence, but also take a look at the surroundings. Of course, it is not possible to predict the future of your chosen neighborhood perfectly, but if you inquire about or examine its perspective now, you can avoid unpleasant surprises. Slot Game Online. According to, some questions you should ask include: - What development plans are in the works for the neighborhood? - Will the street likely become a main street or a popular rush hour shortcut? - Are we talking about a bridge or a motorway that is to be built in the immediate vicinity in five years? - What are the zone laws in the region? - Is there a lot of undeveloped land? What is likely to be built there? - Have the residential values in the neighborhood decreased or increased? If you are satisfied with the answers to these questions, the location of your potential home may keep its pink glow. 10. Offering Too Much When there is a lot of competition in your market and you find a place that you really like, it is all too easy to get involved in a bidding war or try to forestall a bidding war by first offering a high price. However, there are some potential problems. Slot Game Online. Read More : House-Hunting Mistakes Part 3 First, if the house does not value or exceed the amount of your offer, the bank will not grant the loan unless the seller reduces the price or you pay the difference in cash. In this case, unlike your mortgage, the shortfall in your offer must be paid out of your own pocket. Second, if you go to sell the house and the market conditions are similar or worse than when you bought the house, you may be upside down on the mortgage and unable to sell. Slot Game Online. Make sure that the purchase price of the house you buy is reasonable for both the house and the location by examining comparable sales and getting your agent's opinion before submitting a bisnis properti bid. 11. Getting Desperate If you've searched for a while and see nothing you like - or worse, you are outbid by the houses you want - it's easy to desperately search for a new house. However, if you move into a dorm, the transaction costs that will be incurred will be very high. You have to pay a brokerage commission (up to 5% to 6% of the sale price) and you have to pay the closing cost of the mortgage on your new home. You will also have to put up with the effort and costs of moving again. Slot Game Online.

If you have time on your side, it's okay to wait for something appropriate to come to you. As long as your budget requirements are realistic, you need to find something to live with. New houses come onto the market every day. Tags : Real Estate, Properties, House-Hunting, Mistakes, House, Slot Game Online.

0 Comments

Don't underestimate your feelings and don't overestimate your finances Buying a house is a very emotional process. Allowing these emotions to get the most out of you can fall victim to a number of common buyer mistakes. Since home ownership has many far-reaching effects, it is important to keep your emotions in check and make the most rational decision possible. Your goal is to look for a home that you love at a price that you can afford, but unfortunately, many people do things that prevent them from realizing that dream. Let's take a look at some of the most common mistakes made when looking for a home - and how to find a properti properly. House-Hunting Mistakes (Part 3) : 6. Overlook Important Shortcomings According to Agen Sbobet, looking for houses whose full potential has not yet been exhausted, especially if you are on a tight budget. Increasing equity through your upgrades will help push the property managers up. Aside from that, when you buy a house that needs work, you don't buy a fixer upper that is more than you can manage in terms of time, money, or your own abilities. For example, if you think you can do the work yourself, you will find that you won't be able to do it after it starts, and that repairs or upgrades that you've planned will likely cost twice as much if you take the work into Sbobet88 account - and that may not be the case in your budget. Not to mention the initial cost to fix any problems and replace the wasted material. Honestly assess your skills, your budget and how quickly you need to move before you buy a property that is not yet ready to move into. 7. Drag Your Feet It is a difficult balancing act to ensure that you make a careful decision, but not too long to make it. Losing a property that you almost wanted to bid for because someone hit you can be property news heartbreaking. This can also have economic consequences. Read More : House-Hunting Mistakes Part 2 Suppose you are self-employed. Perhaps time is more for you than money for others. The more time and energy you need to search for a house, the less time and energy you have to work. Delaying the home buying process unnecessarily may be the best thing for your business, and the continued success of your business is critical to paying off the mortgage. If you don't pull the Joker123 trigger quickly, someone else might be looking for you. Don't underestimate how time consuming and routine shopping in the house can be. 8. Rushing to Put In An Offer In a hot market, it may be necessary to make an offer quickly if you find a home that you like. However, you need to reconcile the need to make a quick game slot decision with the need to ensure that the house is right for you. Do not neglect important steps such as ensuring that the neighborhood feels safe both at night and during the day (try to visit it at different times) and investigate possible noise problems such as a nearby bisnis properti train.

Ideally, you can take at least one night's sleep to decide. How well you sleep that night and how you feel at home in the morning tells you a lot about whether the decision you are making is the right one. If you take the time to think about the decision, you will also have the opportunity to research slot game how much the property is really worth and to offer a reasonable price. Tags : Real Estate, Properties, House-Hunting, Mistakes, House Don't underestimate your feelings and don't overestimate your finances Buying a house is a very emotional process. Allowing these emotions to get the most out of you can fall victim to a number of common buyer mistakes. Since home ownership has many far-reaching effects, it is important to keep your emotions in check and make the most rational decision possible. Your goal is to look for a slot game home that you love at a price that you can afford, but unfortunately, many people do things that prevent them from realizing that dream. Let's take a look at some of the most common mistakes made when looking for a home - and how to find a properti properly. House-Hunting Mistakes (Part 2) : 3. Not Shopping Around While you should be realistic in your search and compromise to some degree, you shouldn't let up on important things. For example, according to Agen Sbobet, if you know you want children and want three bedrooms, you shouldn't buy a two-bedroom house. For the same reason, you shouldn't buy a condominium just because it is cheaper than a house, if one of the main reasons for surviving in the apartment is because you hate sharing walls with neighbors. It is true that you will likely have to make some compromises to be able to afford your first home, but do not compromise that will be a huge burden. If you're not a high-end home-buying buyer, chances are there are a few others around for every home you like. In most parts of the city there are several houses that are similar or of the same model. They may all have been built by the same builder. Even if you don't find an identical model for bisnis properti sale, you will likely find a house with many of the same properties. If you are considering a condominium or town house, the chances are also in your favor. If you are open to continuing your search, you cannot make rash decisions that you may regret later. Read More : House-Hunting Mistakes Part 1 4. Not Using an Agent If you're seriously looking for a home, don't go into an open sbobet88 house without having a real estate agent or broker (or at least be willing to cross out the name of a person you're supposed to be working with). Representatives are subject to the ethical rule that they must act in the interests of both the seller and the buyer. However, you may find that if you are dealing with a seller's representative, this may not put you in the best negotiating position before contacting one of your own representatives. The majority of buyers - around 87% - bought their house through a real estate agent or broker, according to a 2018 survey by the National Association of Realtors.

5. Neglect to Inspect You have found the perfect place, your offer has been accepted and ... you have a contract! It is tempting to think that once you enter the trust administration, you will be a homeowner, but persevere. Before you complete the Joker123 sale, you need to know what the house is in. You don't want to get stuck with a money pit or the headache of doing many unexpected (and possibly expensive) repairs. For this reason, you need to do a thorough property review - it may even be required by your mortgage lender. By keeping your emotions under control until you have a complete picture of the physical condition of the house and the soundness of your potential game slot investment, you can avoid a serious property news financial mistake. Tags : Real Estate, Properties, House-Hunting, Mistakes, House Don't underestimate your feelings and don't overestimate your finances Buying a house is a very emotional process. Allowing these emotions to get the most out of you can fall victim to a number of common buyer mistakes. Since home game slot ownership has many far-reaching effects, it is important to keep your emotions in check and make the most rational decision possible. Your goal is to look for a home that you love at a price that you can afford, but unfortunately, many people do things that prevent them from realizing that dream. Let's take a look at some of the most common mistakes made when looking for a home - and how to find a property news properly. House-Hunting Mistakes (Part 1) : 1. Not Knowing What You Can Afford Once you fall in love with a particular place, it is difficult to return. You start dreaming how beautiful your life would be if you had all the wonderful things it has to offer, such as the beautiful tree-lined streets, the whirlpool bath, the spacious kitchen with professional appliances ... However, if you cannot or cannot afford this house, only hurt yourself by imagining yourself in it. To avoid temptation, you should limit your purchases to real estate in your financial area. According to Agen Sbobet, if you look at places that are outside your price range, you will feel like something you cannot afford. This can put you in a dangerous position of being financially above your means or making you feel dissatisfied with what you can actually buy. Start your search at the bottom of your price range. If what you find there satisfies you, you don't have to go higher. Remember, if you buy another $ 10,000 worth of house, you're not just paying another $ 10,000. You pay an additional $ 10,000 plus interest, which may double over the life of your Sbobet88 loan. You may be better off using this money for another purpose. Bisnis Properti Read More : REITs VS Crowdfunding Part 2 2. Lack of Vision Sometimes a homebuyer feels like a goldilocks in the house of the three bears: this is too big, that is too small ... The distinction between what can be repaired and what is not is an essential part of the search for an apartment. Even if you just can't afford to replace this hideous wallpaper in the bathroom, it might be worth living with the ugliness for a while and then getting into a house that you can afford. If the house otherwise meets your needs for the big things that are difficult to change, such as: Location and size, do not let physical slot game defects deter you. At the same time, don't be surprised by minor improvements and cosmetic corrections. These are inexpensive tricks that sellers take advantage of your emotions and get a much higher price. Sellers may pay USD 2,000 for minimal upgrades or several thousand USD for deployment. Also, it is often cheaper to upgrade your home even if you need to hire a contractor if you pay the increased Joker123 home value to a seller who has already done the work for you. And you can do it to your taste, not someone else's Properti.

Tags : Real Estate, Properties, House-Hunting, Mistakes, House Most people will benefit from having some of their real estate portfolios. Most investors, however, are not suitable for owning rental properties. This concept has opened up a whole world of investment where someone else manages the property, but individuals can invest in it and bring in some of the profits. There are several ways and methods of investments in properti. The two largest consist of REITs and a newcomer to the game: real estate crowdfunding. Crowdfunding What is crowdfunding? Crowdfunding is nothing new. But with the rise of social media, it has reached new heights. The term refers to raising Mansion88 capital from a large pool of individuals to fund an entrepreneur's project, idea, business, charity, or invention. This enables people to reach a new group of potential investors who go beyond the usual suspects like family, friends and venture capitalists. How does crowdfunding work for real estate? Crowdfunding has opened up new opportunities for people who want to start their own business or project but don't have the money. According to Agen Poker Terpercaya, they also may not have the best credit rating, which automatically prevents them from getting a loan in the traditional way. There are many different websites where a person can collect donations. These crowdfunding sites are a great way for someone to find the investors they need without having to worry about banks or venture capitalists. Real estate crowdfunding works in a similar way. If someone wants to invest in real estate but doesn't want to own or maintain a building, they can become shareholders through a crowdfunding company. All profits directed to the real estate company - profits that come from rental income or the turning of the property - are passed on to the investor. Read More : REITs VS Crowdfunding Part 1 Which Investment Strategy is For You? The idea behind REITs and crowdfunding is that you get a piece of the cake without taking all the risk. But everyone has advantages and disadvantages. Crowdfunding: advantages and disadvantages One of the biggest advantages of investing in real estate crowdfunding is that you can provide less capital for your investment. There are a number of different Joker123 projects that may require as little as $ 500 or $ 1,000. Another advantage of this approach is that there are generally no investment fees, in contrast to the additional costs that can be expected with conventional real estate investments such as acquisition costs or brokerage Bisnis Properti commissions. The disadvantage of investing with crowdfunding is that you have to be an accredited investor for most of these projects. That means you have to meet some specifications set by the United States Securities and Exchange Commission, and many people don't meet these property news guidelines. Summary

- With crowdfunding, entrepreneurs can raise capital for projects of a large group of individuals. - If you don't want to buy slot game property, you can invest in a crowdfunding company that specializes in real estate. Tags : Real Estate, Properties, Crowdfunding, Advantages, Disadvantages Most people will benefit from having some of their real estate portfolios. Most investors, however, are not suitable for owning rental properties. This concept has opened up a whole world of investment where someone else manages the property, but individuals can invest in it and bring in some of the profits. There are several ways and methods of investments in real estate. The two largest consist of REITs and a newcomer to the game: real estate crowdfunding. REITs What is a REIT? According to Agen Poker Terpercaya, real estate investment trusts, commonly known as REITs, have been around since the 1960s and allow investors to invest in property news without actually buying real estate. How do you do that? It's pretty easy. A REIT buys various properties - condominiums, large apartment buildings, hotels, office buildings, warehouses, retail stores and similar objects - and rents them to tenants. Investors buy REIT shares. The rent received by the REIT is distributed to investors in the form of dividends. How REITs Work REITs are tax breaks for companies. This is good news for you, the slot game investor. To qualify, REITs must distribute at least 90% of their earnings to their shareholders as dividends. This helps the company qualify for lower taxation and helps the investor to generate a larger portion of the profits than they could otherwise have achieved. Invest in REITs REIT investors are usually institutional investors. This is because they are complex investment vehicles that are difficult for the average Mansion88 investor to understand. If this type of investment really piques your interest, there are alternatives. You can invest in REITs through mutual funds. This strategy helps to generate the properti profits that result from investing in real estate without any risk. You may also want to take a look at REIT Exchange Traded Funds (ETFs) that you can purchase through a broker. Read More : Real Estate Agents VS Brokers VS Realtors Part 2 Which Investment Strategy is For You? The idea behind REITs and crowdfunding is that you get a piece of the cake without taking all the risk. But everyone has advantages and disadvantages. REITs: advantages and disadvantages REITs offer investors guaranteed income due to the dividend distribution and act relatively simply like stocks. They help diversify a portfolio and offer investors exposure to real estate without having to deal with the headache associated with owning real estate. The main disadvantage that many people have with REITs is that they generally contain higher expenses. These are portfolios that are generally difficult to manage, since real estate can involve significant maintenance costs. Those who run the companies have to make profits, which sometimes means lower returns for the Joker123 investor. Summary

- REITs acquire commercial real estate and distribute the rental income to the shareholders as a dividend. - REITs are traded like stocks, while crowdfunding can be done through a website or social media platform. - Investors can purchase shares in REITs through mutual funds or ETFs. Bisnis Properti Tags : Real Estate, Properties, REITs, Advantages, Disadvantages Overview Many different people work in the real estate property industry, including representatives, appraisers, inspectors and sellers. But sometimes the boundaries between the roles of these people blur a little. In particular, most people are baffled with the terms of real estate agent, broker and realtor and use them interchangeably. While there may be overlaps, the three differ significantly, particularly in terms of their qualifications and where they sit on the career ladder. In short: A real estate agent is an industry professional who serves as an agent for real estate transactions. You are ultimately responsible for bringing buyers and sellers together and receive a commission - a percentage of the sale price of the property. A broker, on the other hand, owns a brokerage company and employs real estate agents. A broker, as a matter of fact, has more training than an agent and handles some of the more technical parts of a transaction. After all, a broker is a member of the broker association. This category includes agents, brokers, sellers, appraisers and other real estate professionals. Brokers are bound by a code of ethics and must be experts in their field. After you know the basic differences, you will learn what each professional does, what qualifications they have and what place they occupy in the real estate industry. Realtors According to Agen Poker Terpercaya, a real estate professional, a realtor, is a member of the National Association of Realtors (NAR) s. To become a member, a real estate professional must adhere to the association's standards and adhere to its code of ethics. Although the word "realtor" is generally confused with the word "real estate agent", the name of a variety of professions in the real estate industry is open, including: - Residential and commercial real estate brokers - Seller - Property Managers - Appraisers In April 2019, the association had more than 1.3 million members nationwide, 68% of whom were licensed commercial agents. A further 20% were brokers and 14% had broker-associate licenses. Anyone who is part of the association is entitled to use the broker brand as part of their name. However, it cannot be used as a label for the professional's license status. Read More : Real Estate Agents VS Brokers VS Realtors Part 1 The realtors are bound by a code of ethics and promise to be transparent and honest and to protect the interests of their customers in all transactions. Realtors should be experts in their field regardless of their role and, as mentioned above, are bound by the association's code of ethics. Joker123 Brokers should deal with their customers honestly and transparently, avoid exaggeration and misrepresentation. They should also do business in the best interests of their customers. Special Considerations Perhaps the biggest difference between the three Agen Poker Online is that a broker can work independently while an agent has to work under a licensed broker. So if you are working with a real estate agent to buy or sell your home, you are actually working with someone who works for a real estate agency. In fact, you hire the agency to help you with the process, with the agent acting as the company's representative. Licensing

Every real estate professional is regulated. Real estate agents and brokers in the United States are licensed by every state, not the federal government. Each state has its own laws that define the types of relationships that can exist between clients and brokers, as well as brokers' obligations to clients and members of the public. Summary - Real estate agents are licensed to facilitate real estate transactions, receive Agen Poker commissions on their sales, and work for brokerages. - Brokers have more experience and are qualified and can work as independent agents or have other agents work for them. - Realtors are part of the National Association of Realtors, a trading organization, and can hold any position within the real estate industry. Tags : Real Estate, Properties, Real Estate Agents, Brokers, Realtors Overview Many different people work in the real estate property industry, including representatives, appraisers, inspectors and sellers. But sometimes the boundaries between the roles of these people blur a little. In particular, most people are baffled with the terms of real estate agent, broker and realtor and use them interchangeably. While there may be overlaps, the three differ significantly, particularly in terms of their qualifications and where they sit on the career ladder. In short: A real estate agent is an industry professional who serves as an agent for real estate transactions. You are ultimately responsible for bringing buyers and sellers together and receive a commission - a percentage of the sale price of the property. A broker, on the other hand, owns a brokerage company and employs real estate agents. A broker, as a matter of fact, has more training than an agent and handles some of the more technical parts of a transaction. After all, a broker is a member of the broker association. This category includes agents, brokers, sellers, appraisers and other real estate professionals. According to Agen Poker Terpercaya, brokers are bound by a code of ethics and must be experts in their field. After you know the basic differences, you will learn what each professional does, what qualifications they have and what place they occupy in the real estate industry. Real Estate Agents A real estate agent is an industry professional who has passed and passed all of the required property classes along with the property license check in the state in which he or she wants to work. As the starting point for most people dealing with real estate, this is the most comprehensive title. Agents are also referred to as real estate professionals. Read More : Formula of Capitalization Rate The real estate agents can represent both buyers and sellers involved in a real estate transaction. A buyer will ask for a wish list for their dream home and try to match it against an available inventory. An agent representing a seller will actively market the property and try to attract buyers. Responsibilities The agents are responsible for passing on offers and counter-offers between the parties and for any queries. An agent works with another agent once an offer is accepted and guides the customer through the process of completing the documentation. They also ensure that their customers know all the requirements for closing the sale, including inspections, relocations, and important dates like the closing. How Real Estate Agents Are Paid Real estate agents work for brokers or agencies and are usually paid on a commission basis. That means they get a percentage of the selling price of a property. That is, the higher the selling price, the higher the commission. Real Estate Brokers A real estate broker is someone who continues his Agen Poker education beyond the level of real estate agent and has successfully passed a state examination for real estate broker. Real estate brokers can work as independent agents or have other agents work for them. Agents who pass the broker exam but work for another broker are usually referred to as real estate brokers. Associated brokers can contribute to the broker's profits in addition to the typical broker's commission. Responsibilities

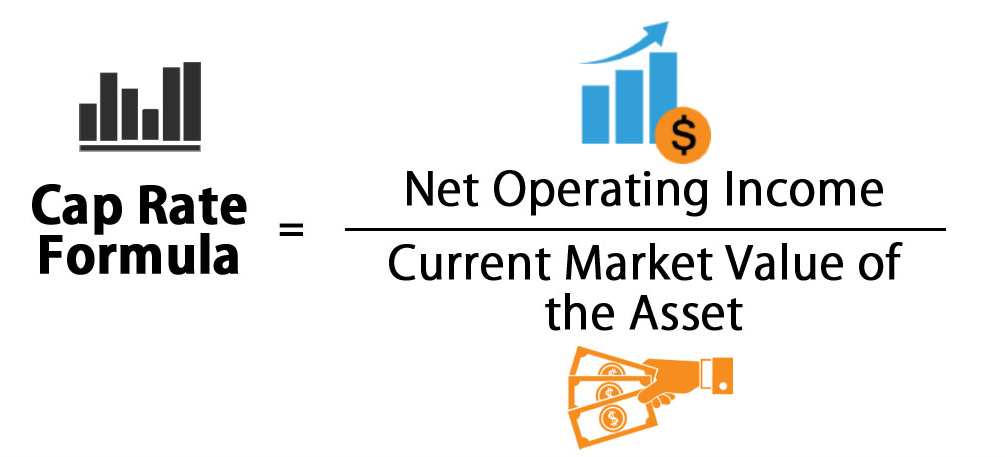

Brokers who work with buyers typically search for properties that meet the criteria set by their clients, negotiate, prepare offers, and help buyers with any other issues that arise prior to the closing date. The brokers of sellers, on the other hand, determine the market value of their customers' properties, list and show properties, communicate with sellers about Joker123 offers and support the offer process. How Brokers Are Paid Like real estate agents, brokers receive a commission as soon as a sale is completed. This amount is listed in the contract between the broker and the buyer or seller. The listing agreement or listing contract generally determines how much of a percentage of the sale goes to the broker. Tags : Real Estate, Properties, Real Estate Agents, Brokers, Realtors The capitalization rate (also known as the cap rate) is used in the world of commercial real estate to indicate the expected return on investment property. This measure is calculated based on the net profit the property is expected to generate and is calculated by dividing the net operating profit by the value of the real estate property and expressing it as a percentage. It is used to estimate the potential return on the investor's investment in the property market. The cap rate can be useful to quickly compare the relative value of similar property investments in the market. However, it should not be used as the only indicator of the strength of an investment, since it does not take into account the leverage effect, the current value of money and the equivalent, including future cash flows from property improvements. There are no clear areas for a good or bad capitalization rate and they largely depend on the context of the property and the Joker123 market. Capitalization Rate Formula There are several versions for calculating the capitalization rate. In the most common formula, the degree of capitalization of a property investment is calculated by dividing the property's net operating income (NOI) by the current market value. Mathematically, Capitalization rate = operating result / current market value Where, The net operating result is the (expected) annual income of the property (such as rents) and is achieved by deducting all costs incurred for the game slot administration of the property. These expenses include the costs paid for the regular maintenance of the system and property taxes. The current market value of the asset is the current value of the property according to the applicable market prices. Read More : Definition of Capitalization Rate According to Agen Poker Terpercaya, in another version, the number is calculated based on the original cost of capital or the cost of a property. Capitalization rate = operating profit / purchase price However, the second version is not very popular for two reasons. First, it gives unrealistic results for old properties that were bought at low prices a few years / decades ago, and secondly, it cannot be applied to inherited properties because their purchase price is zero, making the division impossible. Since property prices fluctuate widely, the first version that uses the current market price is a more accurate representation than the second version that uses the original purchase price with a fixed value. Gordon Model Representation for Cap Rate

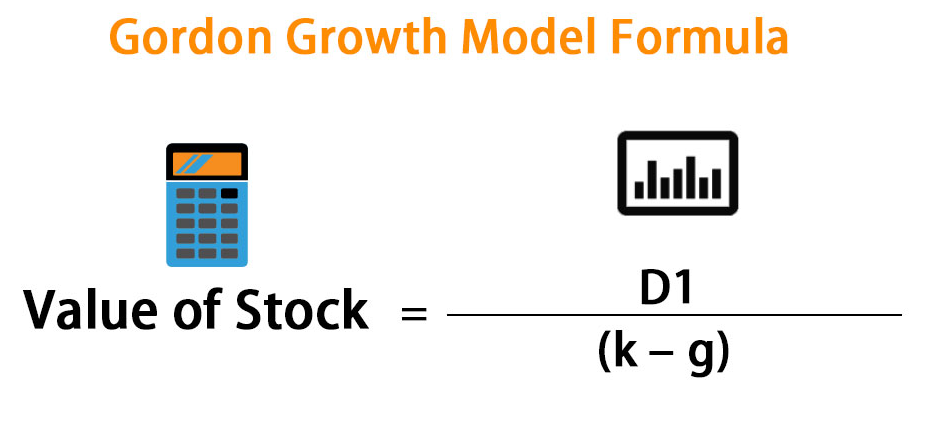

Another representation of the cap rate comes from the Gordon Growth Model, which is also known as the Dividend Discount Model (DDM). This is a method of calculating the intrinsic value of a company's share price regardless of current market conditions. The share value is calculated as the present value of the future dividends of a share. Mathematically, Share value = expected annual dividend cash flow / (return required by investor - expected dividend growth rate) Reorganization of the equation and generalization of the formula beyond the dividend, (Required return - expected growth rate) = expected cash flow / asset The above illustration corresponds to the basic formula of the capitalization rate mentioned in the previous section. The expected cash flow value represents the net operating income and the Agen Sbobet asset corresponds to the current market price of the property. As a result, the capitalization rate corresponds to the difference between the required return and the expected growth rate. That means the cap rate is simply the required return minus the growth rate. Tags : Real Estate, Properties, Capitalization Rate, Formula, Commercial Real Estate What is the Capitalization Rate? The capitalization rate (also known as the cap rate) is used in the world of commercial real estate property to indicate the expected return on investment property. This measure is calculated based on the net profit the property is expected to generate and is calculated by dividing the net operating profit by the value of the property and expressing it as a percentage. It is used to estimate the potential return on the investor's investment in the property market. The cap rate can be useful to quickly compare the relative value of similar Agen Sbobet property investments in the market. However, it should not be used as the only indicator of the strength of an investment, since it does not take into account the leverage effect, the current value of money and the equivalent, including future cash flows from property improvements. There are no clear areas for a good or bad capitalization rate and they largely depend on the context of the property and the market. Understanding the Capitalization Rate The cap rate is the most popular key figure used to evaluate real estate investments in terms of their profitability and return potential. The sbobet88 capitalization rate only reflects the return on a property over a period of one year, provided that the property is bought in cash and not on loan. The capitalization rate indicates the intrinsic, natural and non-leveraged return on the property. Interpretation of the Capitalization Rate According to Joker123, since the cap rates are based on the forecast estimates of future earnings, they are subject to a high degree of variance. It then becomes important to understand what a good capitalization rate is for an investment property. Read More : 7 Steps of A Commercial Real Estate Deal Part 2 The interest rate also indicates the amount of time it takes to get back the amount invested in a property. For example, a property with a 10% capitalization rate will take about 10 years to get the investment back. Different cap rates between different objects or different cap rates over different time horizons on the same object stand for different levels of risk. A look at the formula shows that the cap rate is higher for properties that have a higher operating profit and a lower valuation, and vice versa. Suppose there are two properties that are similar in all attributes, except that they are geographically separate. One is in a posh downtown area, while the other is on the outskirts. Under the same conditions, the first property will get a higher rent compared to the second, but this will be partially offset by higher maintenance costs and higher taxes. Due to its significantly high market value, the inner city property will have a relatively lower cap rate compared to the second property.

This indicates that a lower cap corresponds to a better slot game valuation and a better prospect of return with less risk. On the other hand, a higher cap value implies relatively less prospects for a return on real estate investments and thus a higher risk. While the hypothetical example above makes it easy for an investor to choose a property in the city center, real-world scenarios may not be that easy. The investor who values a property based on the capitalization rate faces the challenging task of determining the appropriate capitalization rate for a certain level of risk. Tags : Real Estate, Properties, Capitalization Rate, Definition, Commercial Real Estate |