|

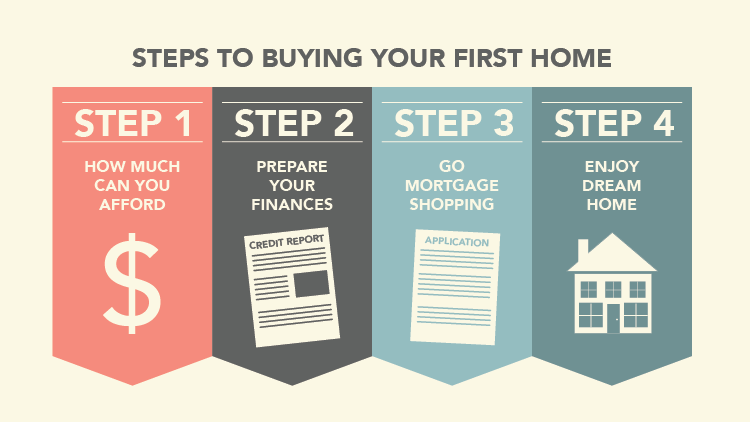

Meeting all requirements for a Mortgage

Most home purchasers don't have a reserve of money standing by close by to purchase a home without a home loan. So to sort out what value you can pay for a home, you have to discover what measure advance you will meet all requirements for. The home loan prequalification is a prologue to the credit capability measure that includes a concise, casual gathering with an advance operator or dealer to set up what size advance a moneylender is probably going to give you. This credit sum, in addition to the money you have for an up front installment and shutting costs, will figure out what value home you can manage. You ought to get yourself pre-qualified before you begin taking a gander at property. This spares time and evades the disappointment of taking a gander at homes that are way out of your value range. Make an arrangement for a prequalification meet and be set up to talk about the close subtleties of your money related circumstance. Take data with you about your pay, time allotment at your specific employment, resources and obligations. Be totally authentic with the advance specialist. Banks can be fanatics for acceptable credit, so the home loan intermediary will need to run a credit beware of you. Numerous individuals are more disposed to stand by until they are going to secure in an agreement to have their credit checked, yet it is smarter to know ahead of time if there is anything on your credit record that could keep you from being endorsed. Furthermore, the advance specialist will have the option to encourage you what to tidy up on your credit record if necessary. Or on the other hand, he/she might have the option to guide you to a bank who might be happy to give you an advance despite the fact that your credit report has a few flaws. Ask the credit specialist or intermediary to compose a pre-capability letter showing that you have been pre-qualified for an advance. Merchants are responsive to offers from purchasers who have a pre-capability letter from a loan specialist or home loan representative. This can work in support of yourself if there are different purchasers offering against you for the property. What's your optimal value range? Most purchasers have a thought of the amount they might want to spend every month for a home. This sum is regularly founded on what they are at present paying for lease. In spite of the fact that it isn't insightful to extend yourself also think where funds are concerned, you should consider the assessment points of interest of home proprietorship while deciding your optimal value range. Thinking about the duty reserve funds, you can most likely bear to pay around 25 percent more for a home than you may might suspect you can. Assume you need to pay close to $1,100. every month for a home. This must take care of the expense of your head and intrigue, property assessments and peril protection. Property assessments and protection differ starting with one area then onto the next. Here's an Example to sort out your installment: If your property assessments and protection make up around 15 percent of your PITI (head, intrigue, expenses and protection). In the event that you take away 15 percent ($165.) from $1,100, this leaves you with $935. every month to use for a home loan installment. On the off chance that you get a flexible rate contract with a beginning pace of 7.5 percent, $935 every month will get you a credit in the measure of roughly $133,750. In the event that you have enough money for a 10 percent money initial installment, your spending will permit you to purchase a home for roughly $149,000. The cutoff to your optimal cost will be controlled by the greatest home value you can fit the bill for as dictated by loan specialist endorsing rules. In any event, when affirmed, numerous purchasers will decide to pay not exactly the greatest they can manage. Building up your optimal cost is an individual choice that will rely upon different elements. Your present and foreseen revenue stream is one significant thought. In the event that your pay is rising quickly, you might need to stretch and purchase a more costly home now instead of need to move again soon. Different contemplations are: Do you have any drawn out obligations you need to pay off? Do you have enough money stores to deal with an unforeseen emergency, just as unsurprising home upkeep costs? What amount of extra cash do you have? Some planned home purchasers think that its valuable to set up a fiscal summary and month to month working cost financial plan. This will assist you with deciding exactly how much money it takes for you to endure every month. Property News, Bisnis Properti, Properti, Joker123, Slot Game, Game Slot, Sbobet88, Agen Sbobet, Slot Online.

0 Comments

Leave a Reply. |